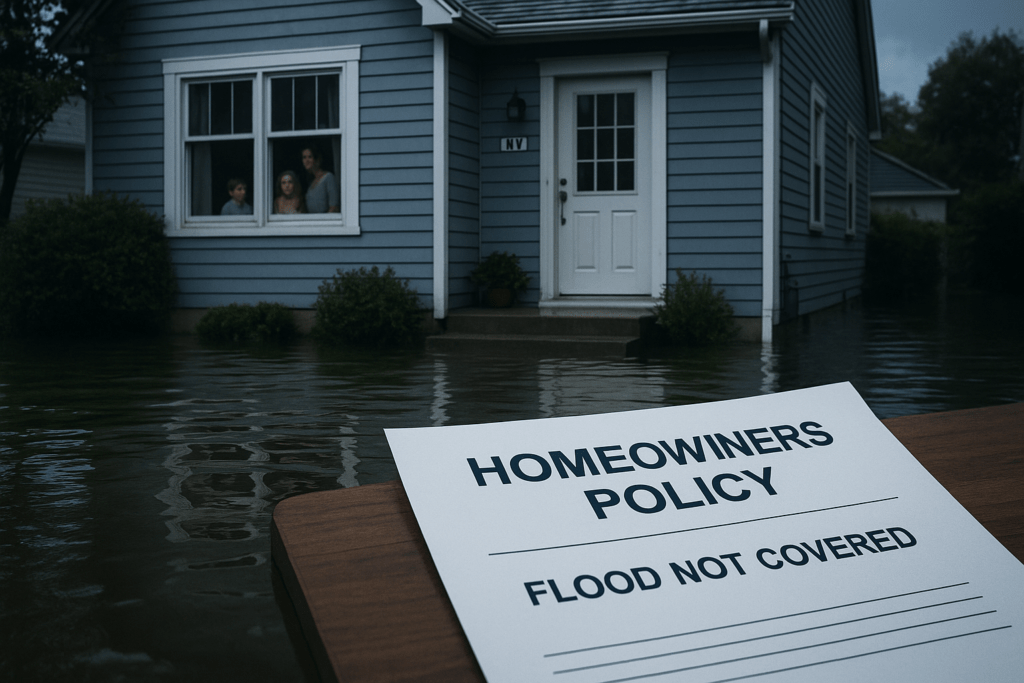

Why Your Homeowners Insurance Won’t Save You from Flood Damage

When it comes to protecting your home in Ocean County, most homeowners believe their standard insurance policy has them covered for nearly anything. It’s an understandable assumption—your policy covers wind damage, fire, theft, even burst pipes. But when it comes to flooding, even the best standard homeowners insurance leaves a huge, often unexpected, gap.

The Surprising Truth About Homeowners Insurance

Flood damage isn’t covered by most home insurance policies.

No matter how carefully you choose your plan, nearly every traditional policy from any insurance carrier specifically excludes flood damage caused by rising water.Here in Ocean County, with our many rivers, the Barnegat Bay, and direct access to the Atlantic, this is a big deal. Weather events like hurricanes, nor’easters, and even pop-up summer storms can send water sweeping into basements, crawl spaces, and first floors. After a major storm, many local families discover too late that none of the repairs are covered by their standard policy.

What Do Insurers Mean by “Flood Damage”?

Flood damage refers to “rising water” entering your home—whether that’s from heavy rain overwhelming local drains, rivers and bays exceeding their banks, or ocean water surging inland during a storm.

It does not include things like a burst pipe or a failed water heater (those are typically covered).This technical wording leads to a lot of confusion:

- If rain pours in through your roof, that’s wind/hurricane damage—often covered.

- If water seeps through doors, windows, or the foundation because of flooding outside, that’s considered flooding—usually not covered.

Real Local Examples

After Hurricane Sandy, many Ocean County residents filed claims for ruined basements, destroyed flooring, or lost belongings, only to find their home policy did not pay for any of it.

Most were shocked—their policy covered the wind damage, but not the water that actually caused the worst destruction.

What You Risk Without Flood Insurance

If you live in Toms River, Brick, Lakewood, Point Pleasant, or anywhere along our coast, even properties outside designated high-risk flood zones are vulnerable. About 25% of all flood claims come from “low or moderate risk” areas.Without dedicated flood insurance, you risk:

- Paying out-of-pocket for major structural repairs (walls, flooring, appliances)

- Losing personal belongings with no reimbursement

- Compromising your home’s safety and resale value

FEMA puts the average flood claim at over $30,000—and coastal flooding can run much higher. Standard disaster assistance is limited and hard to qualify for.

The Solution: Flood Insurance

Flood insurance—backed by the National Flood Insurance Program (NFIP) or private firms—steps in where your homeowners insurance stops. It’s designed to cover your actual losses due to flooding, from cleanup to repairs and replacement of personal property.At Blue Water Agency, we walk you through your risk and help you find the right policy for your property, your neighborhood, and your budget.

Take Action Before the Storm

The most important thing to know:

There’s a 30-day waiting period for new flood insurance policies. Coverage won’t start the day you buy—don’t wait until a storm is on the horizon.Protect your biggest investment and your peace of mind—talk to a local expert who understands Ocean County’s unique flood risks.

Questions about your current coverage or need a flood quote? Call Blue Water Agency at (732) 898-0460 or visit our website for help today.