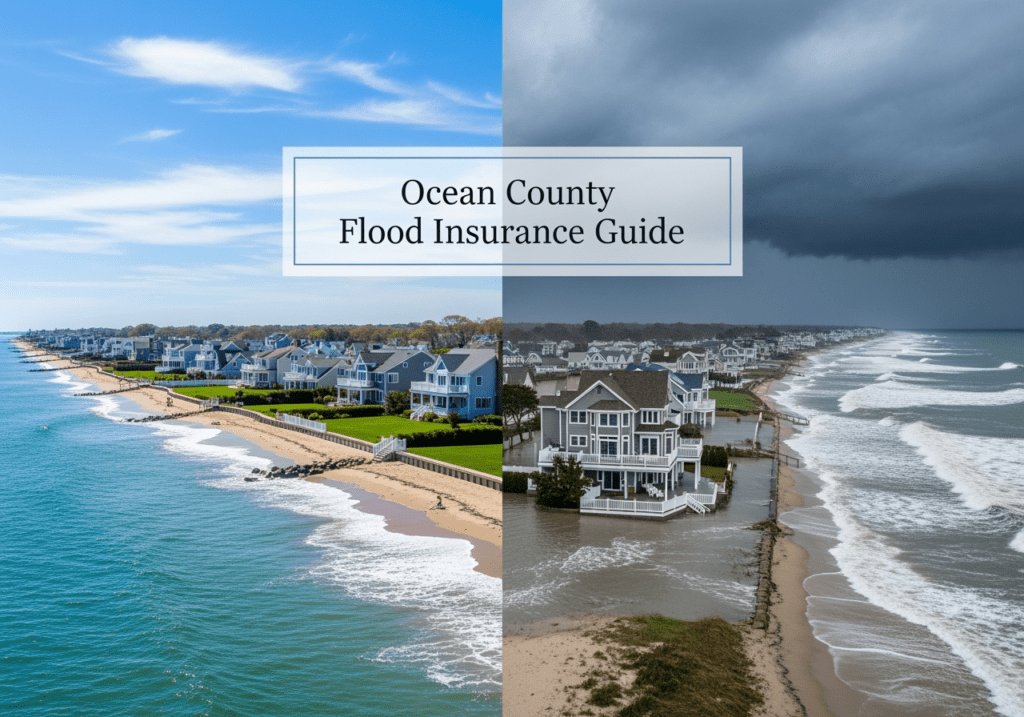

Ocean County’s Hidden Flood Risks: What Every Homeowner Should Know

Living along New Jersey’s beautiful coastline brings incredible benefits, but Ocean County residents face unique flood risks that many don’t fully understand until it’s too late.Ocean County sits directly on the Atlantic coast, making it one of New Jersey’s most flood-vulnerable regions. While we enjoy stunning ocean views, beach access, and vibrant coastal communities, our location exposes us to multiple types of flooding that can catch even prepared homeowners off guard.

Understanding Our Local Flood Risks

Storm Surge from Coastal Storms

Hurricane Sandy in 2012 showed us just how devastating storm surge can be. Ocean water pushed miles inland, flooding communities that residents thought were safe from coastal flooding. Hurricanes and nor’easters regularly threaten our coastline, and each storm brings the potential for significant surge flooding.

Flash Flooding from Heavy Rainfall

Even without coastal storms, Ocean County faces flood risk from heavy rainfall. Our local drainage systems can become overwhelmed during intense storms, creating flash flooding in areas that seem completely safe from water damage.

Inland Water Sources

FEMA flood maps reveal that significant portions of inland Ocean County are in flood zones due to rivers, streams, and our region’s unique topography. Properties near the Toms River, Metedeconk River, and other waterways face year-round flood risk.

The Critical Gap in Your Coverage

Here’s what surprises most homeowners: your standard homeowners insurance policy specifically excludes flood damage. This means if storm surge, heavy rainfall, or rising water damages your home, your regular insurance won’t help. We’ve seen too many Ocean County families discover this the hard way. Your homeowners policy might cover wind damage from a hurricane, but if that same storm causes flooding that damages your basement, foundation, or first floor, you’re responsible for those costs without separate flood insurance . This distinction is crucial because coastal storms often bring both wind and flood damage to the same property. Without flood insurance, you might find yourself paying out of pocket for the most expensive part of storm damage repairs.

Why Flood Insurance Matters for Coastal Residents

The National Flood Insurance Program (NFIP) provides coverage specifically designed for situations your homeowners policy won’t handle. For Ocean County residents, this protection is essential.

Comprehensive Coverage

NFIP policies cover both your dwelling (up to $250,000) and personal property (up to $100,000). This includes not just structural repairs, but also replacement of damaged furniture, appliances, and belongings.

Storm Surge Protection

Unlike homeowners insurance, flood insurance covers damage from storm surge – exactly the type of flooding Ocean County faces during major coastal storms.

Important Timing Consideration

Flood insurance typically has a 30-day waiting period before coverage begins. You can’t wait until a storm is approaching to purchase coverage.

Assessing Your Personal Risk

Not every Ocean County property faces the same flood risk. Your specific risk depends on several key factors:

Check Your Flood Zone

Review your property’s designation on FEMA’s flood maps. Properties in high-risk zones (starting with “A” or “V”) face the greatest risk, but don’t assume you’re safe in moderate or low-risk zones. About 25% of flood insurance claims come from properties outside high-risk areas.

Consider Your Elevation

Think about your property’s elevation relative to nearby water sources. Ocean County’s relatively flat topography means water can travel significant distances during major flooding events.

Evaluate Your Home’s Vulnerabilities

Finished basements, ground-level utilities, and homes on slabs all face different flood risks. Even a few inches of water can cause thousands of dollars in damage to flooring, drywall, and electrical systems.

Taking Action Today

If you’re an Ocean County resident, here are practical steps to protect your property and finances:

- Get a flood insurance quote – even if you think your risk is low, understanding your options and costs provides valuable peace of mind.

- Remember mortgage requirements – if you have a mortgage on a property in a high-risk flood zone, flood insurance is required.

- Consider cost versus potential loss – flood insurance premiums are often less expensive than people expect, especially compared to potential flood damage costs.

- Document your belongings now – create an inventory of your home’s contents before any flooding occurs to streamline the claims process.

Local Expertise You Can Trust

As an independent insurance agency serving Ocean County, Blue Water Agency understands the specific flood risks facing our coastal communities. We work with multiple insurance carriers and can help you navigate both NFIP options and private flood insurance alternatives. Our experienced team has helped numerous Ocean County families secure appropriate flood coverage. We understand local conditions throughout the region and provide personalized recommendations based on your specific property and situation.

Ready to protect your Ocean County home?

Contact Blue Water Agency at (732) 898-0460 or visit www.bluewateragencyllc.com for your free flood insurance consultation. We’re available Monday through Friday, 8:00am to 6:00pm.

Don’t wait until the next storm threatens our coast. Flood insurance protection starts with a conversation – and that conversation starts today.